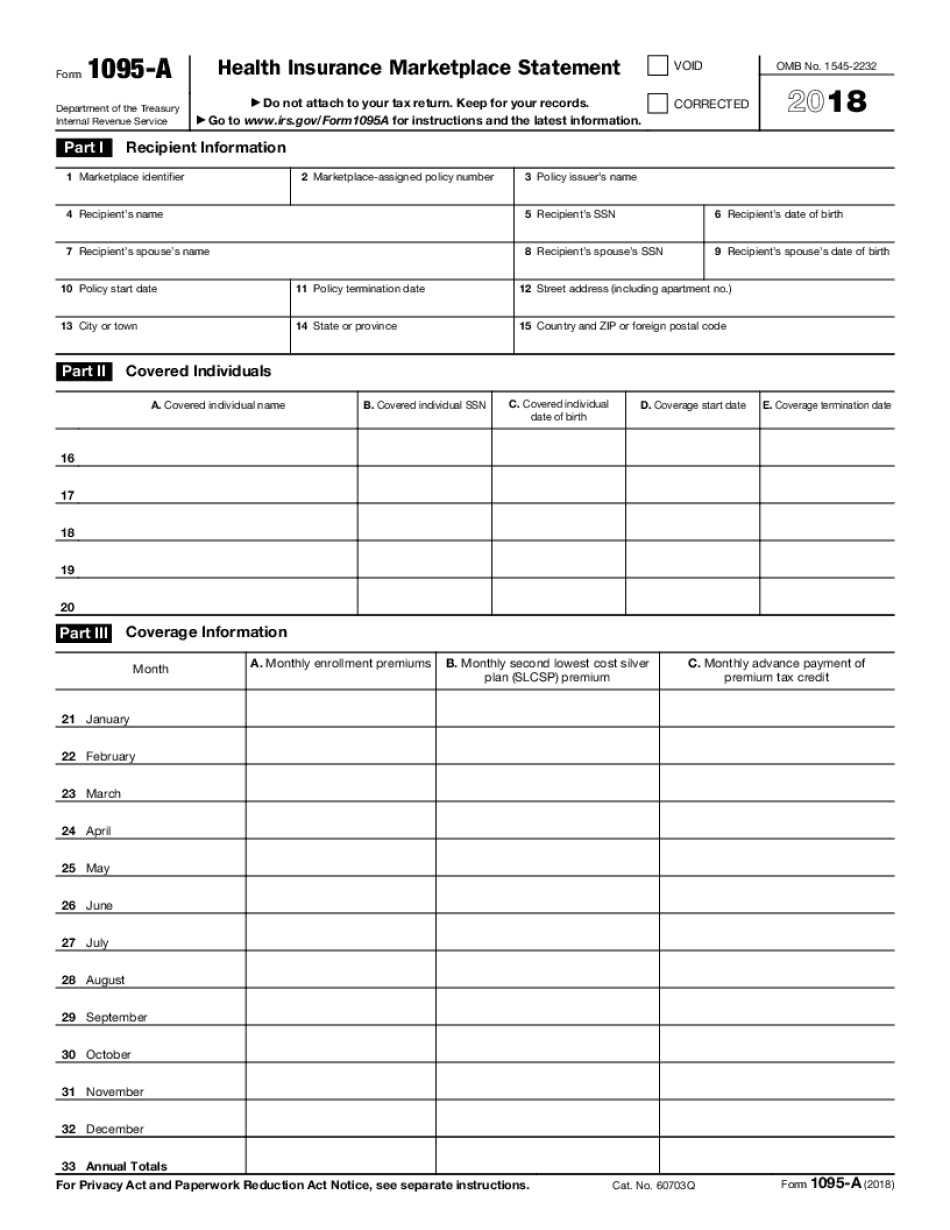

Filling out IRS 1095-A 2018 Form online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to IRS 1095-A 2025 Form

Every citizen must declare their finances in a timely manner during tax period, providing information the IRS requires as accurately as possible. If you need to IRS 1095-A 2025 Form, our trustworthy and straightforward service is here at your disposal.

Make the following steps to IRS 1095-A 2025 Form quickly and precisely:

- 01Import our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official instructions (if available) for your form fill-out and precisely provide all information required in their appropriate fields.

- 03Fill out your template utilizing the Text tool and our editors navigation to be sure youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Use the Highlight option to accentuate specific details and Erase if something is not applicable anymore.

- 06Click the page arrangements key on the left to rotate or remove unnecessary document sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your tax statement from our editor or choose Mail by USPS to request postal document delivery.

Opt for the most efficient way to IRS 1095-A 2025 Form and declare your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

Watch our video guide to learn how to prepare IRS 1095-A 2018 Form

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of IRS 1095-A 2018 Form?

You should see the instructions for the current year Form 1096, Employer's Estimated Tax Return for the Tax Year.

You want to get a refund from an employer (not from an individual)? If you are a U.S. citizen under age 65, you are eligible for a free electronic filing in your file, or you can get the form in paper. You should fill out the W-4 (or W-2) form in the IRS website.

File Form 1097-C (Employer's State Unemployment Insurance Withholding) to get the ETC refund using your regular tax return.

Income tax you paid to workers who are exempt from Social Security and Medicare: you should file an e-file or paper Form SS-8, Social Security Supplement.

If you're a resident alien, you should file a Form W-8-BEN. The Form W-8-BEN shows you're not subject to U.S. withholding when you file Form 1040.

EI benefits paid to a nonresident alien, including U.S.

Who should complete IRS 1095-A 2018 Form?

A: IRS 1095-A should be completed by individuals who earned over 600,000 in 2016, are self-employed or will be in the year 2019 and before and will have at least 125 full-time-equivalent employees by year's end, and will have 1,000,000 or more of total investment income that they report on their 2017 federal return.

B: Individuals earning 600,000 or less in 2016 should complete IRS Form 1040.

C: If this income is below those thresholds but more than 20,000 during the year, complete IRS Form 1040A.

D: File IRS Form 1040 if you expect your net investment income to exceed 20,000.

E: File Forms 1042, 1045 and 1041 (or 1046 if a spouse) if you expect your net investment income to exceed 50,000 for the year.

Where to complete your 1095-A? A: Complete the form.

B: Download a PDF version of Form 1095-B, Employer's Tax Return for Tax Year 2016 by Establishing and Collecting the Self-Employed Status.

C: Print the form, complete and sign it and mail it to the IRS.

D: Go directly to IRS.gov and complete IRS Form 1040-EZ, Employer's Self-Employed Federal Tax Return.

E: Fill out IRS forms and make sure everything is filled on each page.

F: Download an IRS Form 886-EZ. If you have been issued a new 1098-EZ that requires a new self-employment income, fill out 1098-EZ again and submit the new form.

How to file your self-employment tax? A: Use the self-employment tax form (Form 1040-EZ or 1040-NR) filed for 2017 and earlier years (2016, 2015, 2014, 2013, 2012, 2011 or 2010) with the appropriate classification on Form 2555, Employer's TANK/FTC Employer's Quarterly Federal Unemployment (Table 5). If you do not have a 1040, submit the self-employment tax form.

When do I need to complete IRS 1095-A 2018 Form?

When you file your 1040, W-2, or 1099 for the calendar year.

How long does it take to get a copy of my filed Form 1095-A?

Your Form 1095-A is sent directly to you and includes a Certificate of Service (COS) number on it. You can get the exact COS number by going to IRS.gov/Form1095A.

How can I find out if an IRS representative knows the information in my submitted form?

Call or go to IRS.gov/LiveHelp to go directly to the agent or staff member answering your question.

Can I get additional copies of my Form 1095-A?

Yes. You should call or go to IRS.gov/ServiceTax for the option to request additional copies of your Form 1095-A. You should include a copy of your Form 1095-A and copies of all your other tax returns for the year requested. Furthermore, you may get copies in paper, electronic or hard copy form.

I received a copy of my Form 1095-A. Did I file it?

If you received a copy of your Form 1095-A with the mailing address on it, but you haven't yet filed your tax return for the whole year that you received the Form 1095-A, you will still need to file, as the IRS has asked taxpayers who submitted their Form 1095-A for additional information. To determine if you need to file, you should contact the address listed on your Form 1095-A.

Do I need to wait for the IRS to send out my final Form 1095-A?

No. You should file your tax return electronically by April 15.

What happens in the interim period when I receive a copy of my 1095-A?

There is no penalty for submitting your tax return electronically. If you filed by paper, you will receive a paper copy of your 1095-A, so you may want to print it out to keep.

How do I check if I received my 1095-A?

The IRS also sends you a letter when you receive your Form 1095-A. It contains a notice saying “If an inquiry is received about your return, please provide the requested information or explain how you believe it could not include the requested information.

Can I create my own IRS 1095-A 2018 Form?

Yes, you may download a 2017 tax form here.

How can I receive a refund?

You should receive a refund. A refund check will be mailed to the address on record with the IRS within seven to 10 business days after the end of the tax year.

How can I get certified mail return forms to support my refund request?

You may request certified mail Return Forms that are accepted by the IRS by writing to: U.S. Dept. of the Treasury

Internal Revenue Service

Attn: Return Forms and Appeals Unit

P.O. Box 300839

Washington, DC 20024 Make sure to provide as much detail as possible. You can view the Form 7006 which can help you in obtaining a certified mail return form.

Can I file an amended return?

You will receive IRS approval for an amended form only after you meet all the requirements outlined in the IRS published “Filing Instructions for Tax Returns” located at: It is not necessary to file Form 7006 with an amended tax return, and you should not submit amended return forms to the IRS.

Can I file a federal income tax return?

You can also file a tax return online through the “Complete a Tax Return” link here.

Who is eligible for the “additional filing” benefit?

For “additional filing” information, please refer to IRS Publication 535.

Can the IRS verify my filing status on my e-file income tax return?

Yes, the IRS may accept these electronic filings including 1040, 1040A and 1040EZ for tax returns that have been filed online. An e-file verification letter requesting additional information from the federal income tax returns being e-filed are sent and can be filed electronically by the recipient.

Who is not eligible for the “additional filing” benefit?

Persons claiming tax credits and tax deductions for which refunds are based on Form 1040EZ or Form 1040A may not receive an e-filing letter from the IRS to verify their tax returns. Anyone who files a tax return not required to be filed electronically as part of a Form 1040-PR or 1040NR would be not be eligible for an e-filing letter.

What should I do with IRS 1095-A 2018 Form when it’s complete?

Use IRS 1095-A as you wish. You will not have to make adjustments before filing your tax return.

Returning Your IRS 1095-A Form

Do I have to give the Internal Revenue Service, or a person at the IRS, my 1095-A form?

No, you do not need to give your 1095-A form to an IRS employee, tax preparer, or other individual. Simply keep your copy in a safe place with your taxes. If you wish to give your form to another individual, you can use IRS Form 1095-A-X.

How do I get my IRS 1095-A 2018 Form?

Once you have signed up, you can get your 1095-A 2018 Form from your employer, the IRS, the IRS customer service phone number or by going to IRS.gov.

How do I get my Social Security number and/or Taxpayer Identification Number (TIN)?

Visit the IRS.gov website and enter your TIN or select IRS.gov from the top navigation bar and enter the TIN to see your SSN or TIN if you have one.

What information do I need to get a 1099-MISC?

The form will provide the tax year and total earnings as well as the number of qualified dividends or interest income and the number of qualified capital gains and losses.

Do I have to pay taxes on foreign earnings on my Form 1099-MISC?

This is a tax treaty signatory country which means its own tax laws apply. The IRS currently does not offer foreign earnings with Form 1099-MISC. You should contact the country you have to determine if you have to pay taxes on that income.

What is the name of the IRS eT1098-MISC I filed? How do I get my eT1098-MISC?

If you file a federal tax return and your eT1098-MISC itemizes deductions (except charitable contributions to registered charities which are not taxable) you will get an eT1098-MISC which will also list your employer and the gross wages. You should attach this form to your tax return and include your employer information on the completed eT1098-MISC as discussed in How To Itemize Deductions in Your Federal Tax Return.

Will Form 1099-MISC be mailed to me or sent to the address provided?

Form 1099-MISC is a Form 1099-MISC, a Schedule C, or Form 1099-MISC, and Form 1099-MISCE, Form 1099-MISC E or Form 1099-MISC EMC. Please note:

If you file Form 1097 or 1098, Form 1099-B, or Form 1099, Schedule C, on the same day as your return due date (generally 15 days before the due date), your Form 1099-MISC will automatically be sent to the address you provided.

What documents do I need to attach to my IRS 1095-A 2018 Form?

The 1095-A is required if your employer pays you wages, and is used to report and pay taxes on a variety of financial transactions that you make with your employer — including W-2s, paychecks issued you by your employer, and other wages.

What documents are I allowed to attach to my 1095-A?

You can only attach non-filing documents if your total amount of 1095-A attachments is under 100.

What document types will be accepted in 1099 and 1095-A Forms?

You may attach just about anything to your 1099 or 1095-A. Some examples include:

Pay stubs from work,

Wages,

Bills,

PERSONAL ITEMS

My employer withheld 1099-MISC and 1095-MISC Form W-2 from my W-2, and have not paid me in the past. What should I do?

Your employer likely withheld 1099-MISC and 1095-MISC due to the failure to issue a Form 1095-MISC with wages. If you have questions about withholding, contact your employer directly.

My employer withheld 1099-INT and 1095-INT Form W-2 from my W-2, but they are being held for my benefit until they can pay me. What should I do?

If your employer withheld 1099-INT and 1095-INT, a Form 1095-INT, may be received along with your W-2. The following documents may also be included:

Wages,

PERSONAL ITEMS

My employer withheld 1099 and 1099-INT from my W-2. Now that I have a 1040, will they send 1099-INT to me?

It would be most appropriate to continue to work and file Schedule C of Form 943. The following documents may also be included:

Wages,

PERSONAL ITEMS

My employer withheld 1099 from my W-2. They are sending me 1099-INT. Is this correct?

No; 1099-INT should not be sent as part of a 1099-MISC statement unless you are requesting a Form W-2 in response to a return to Form 1040X, W-2.

My employer is sending me 1099-MISC.

What are the different types of IRS 1095-A 2018 Form?

Read about the most common 1095-A forms in this summary.

If you need more help getting your 1095-A form, check out our article that describes the different types of IRS 1095-A forms. In addition, some of these answers provide additional details on the IRS 1095-A form you've received.

Top of page

How do I find my 1095-A form online?

The IRS offers several methods for finding your 1095-A form online:

You can find your 1095-A in the forms folder on the IRS website or on our secure website for submitting 1095-A's. Use these methods to submit your 1095-A or 1095-A-T.

You can download the 1095-A or 1095-A-T form online to be used to file your federal income tax returns. You can obtain your 1095-A by completing the Online 1095-A Request Form or you can submit a paper 1095-A or 1095-A-T.

Use one of the following services to download your 1095-A form.

You will need a computer or access to a web browser with the Internet capability to download the form.

You can print your 1095-A form. Furthermore, you can obtain your 1095-A using the same methods listed below.

Top of page

Why do I have to send the IRS my 1097-A?

The 1097-A is a tax instruction document designed to simplify the process to report your gross income on your federal income tax return.

Your 1097-A is completed by you and not someone from the IRS.

This form doesn't have to be mailed after receiving it. To sign and date your Form 1097-A, print a paper copy and then sign the form.

Top of page

How do I sign and date my 1097-A?

To sign and date your form, print a new sheet of paper and sign and date it. You'll need to sign and date a paper copy of your 1097-A if you want to use it to file your taxes. The signature on the form must be your own.

How many people fill out IRS 1095-A 2018 Form each year?

That's something people are not quite aware of. Let's look at tax statistics from 2016, the most recent data we are aware of.

According to IRS Statistics:

Total Number of 1095-A Filers: 1.2 Million

Tax Return Periods Filed During 2016: Tax return filed in April, April 30, May 1, June 1, June 30, July 1, July 31, September 25, October 26, November 25, November 28, December 25, December 31

This number of tax return filed was 1 percent lower than 2015. It's worth noting IRS statistics include only individuals and households and are for individual taxpayers only.

Who is the #1 biggest filer?

#1 Filers Total Number of 1 million filers 1,020,831 Individuals in Group 1 (1095-A filers, single taxpayers. Married taxpayers filing separately, filing jointly, and qualifying widows).

How many people use IRS 1095-A during 2016?

# of Non-Partisans IRS 1095-A Filers (2017): 17,936 Average Number of 1095-A filers in 2017: 4.4 Individual Taxpayers — Individual filers: 1,030,966 Individual filers in group 1 — Individual filers: 5,835

How many people use Tax Return Form 1040?

# of Non-Partisans Tax Return Form 1040 Filers (2017): 10,842 Average Number of 1040 filers in 2017: 8.0 Individual Taxpayers — Individual filers: 15,851 Individual filers in group 1 — Individual filers: 15,851

Which is the most used tax return in 2017?

# of Non-Partisans Tax Return 1 Individual Taxpayers (2017): 13,818 Total Number of 1 million filers IRS Tax Return (2017): 10,842

Tax Return Number on IRS 1040 Tax Liability: 8,000 Liability for Single filer under 75K in 2017: 3,500 Liability for Married filers filing jointly under 150K in 2017: 10,100 Additional Information: Liability for single filers over 75K: Tax is equal to 3.5% of income. Liability for married filers filing jointly: Tax is equal to 14.

Is there a due date for IRS 1095-A 2018 Form?

Do I need to pay penalties for filing under penalty of perjury?

(4) How do I prepare/get IRS 1095-A and 1095-A-NR?

(5) Do I have to itemize my marginal and itemized deductions?

(6) Do I need an IRS e-file for tax year 2018 Form 1095-A?

(7) What is Schedule A, Schedule C, Schedule E, Schedule F?

(8) I've filed 1040, 1040A, 1040EZ and other 1040 forms. Now what?

(9) My tax return didn't go through correctly on a credit card. What should I do?

(10) How come my refund wasn't on time?

(11) How come my taxes have gone up?

(12) How do I correct a mistaken filing of Schedule C for my tax due in 2019 and 2020?

(13) My taxes have been delayed for 4 months — can I get extensions this year for the same reasons?

(14) I got a tax notice for tax year 2017 from June 2018 that is not reflected in my return. Can I correct my tax return for 2018 using 2018 Form 1040?

(15) I'm having trouble with my federal credit card payment. Can I get a tax extension?

(16) My child's school is closing. Do I need to file a joint return to claim the child as a dependent this year?

Filed the 2017 tax return. Do I still need to file?

Most people have already filed their tax return before October 17, 2018, for 2019; therefore you should receive a new Form W-7 (or 1099-R) from the IRS by November 23, 2018.

2018 Filing Information For 2017 To 2018 Filing

For 2017, you need to file Form 1040 or 1040A because your tax due date is October 17, 2018, for that year rather than due the end of February 2017. Your return also needs to comply with the filing requirements for 2018 (Forms 1040-A and 1040-B) which you should file by April 17, 2018.

If you believe that this page should be taken down, please follow our DMCA take down process here