Award-winning PDF software

caution: not for filing - internal revenue service

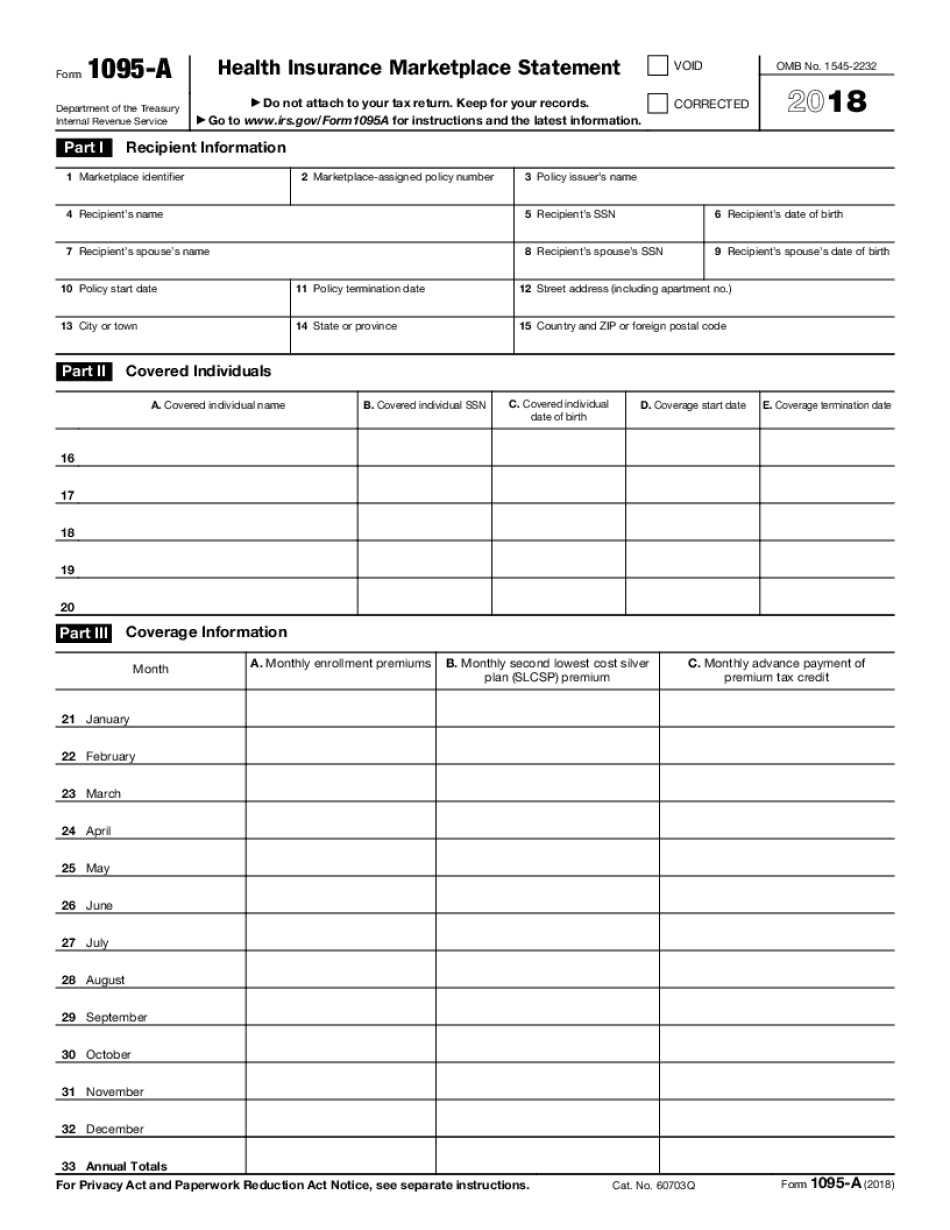

Information for the individual and family market is generally available in the following forms:The Marketplace uses the following standard Form 1095-A forms for filing:Filing Information for the Large Employer/Youth Tax Credit Marketplace uses Form W-2, Employee's Supplemental Income (Form W-2G) for reporting:the amount of the employer's contribution to the Health Insurance Form 8963 from the Taxpayers' Fund for Health Insurance Marketplace uses Form 1095-A to report the contribution amount. The Form 1095-A also reports the individual's contribution. In addition, an employee must report the amount of any employer-provided premium subsidy with an amount of at least 100 or more in which case the taxpayer is responsible to make the entire premium subsidy on behalf of the employee. The premium subsidy amount must be reported on an Internal Revenue Service Form the event that neither Form 8963 nor Form 1095-A are available for the following individuals:Form 1095-A is available from.

instructions for form 1095-a - internal revenue service

Qualified Individuals can be: A citizen of the United States (or, if a citizen, at least one of the following: A domestic corporation that is a parent or domestic successor-in-interest of a person that is a citizen of the United States who is domiciled in the United States and that is authorized to transact business in the United States; A foreign corporation or foreign partnership, if it is a shareholder or if it is an entity with respect to which a written certification of qualification is filed with the IRS; A state or a political subdivision of a state; A resident of a hospital trust established under section 330 of the Medicare, Medicaid and SHIP Reauthorization and Extension Act (CHOPRA) for a hospital for the treatment of indigent persons pursuant to section 1902(e)(15) of such Act as of the date the individual or his or her estate elects to treat such individual as a.

About form 1095-a, health insurance marketplace statement

Coverage of certain individuals required to furnish information.

How to use form 1095-a, health insurance marketplace statement

File IRS form 1099-K if you received any taxable interest, dividends, or capital gains during the tax year. Learn why it's important to register for as soon as you receive an IRS notice. The IRS has an online form for you to fill out to file the tax return electronically. Once you download and fill out the online form, you will print it and mail it to the IRS, so you don't have to mail the paper IRS notice. Online taxpayers, please visit this article if you need help and how to fill out the form A quick word before you send the paper form to the IRS? Remember that you must fill out an IRS tax return for each person who has been a client of your tax preparation services. This includes the following: A married couple filing a joint return A head of household (one adult in the household is the head of household) A.

Had marketplace coverage?

April 1, 2018, This is a new rule under section 6322. April 1, 2018, Form 1095-EZ is a free option. April 1, 2018, IRS has a list of what constitutes an eligible educational institution, a qualifying job-placement program or an approved tax-exempt organization. The list is available at This is the rule regarding the tax-free amount. April 1, 2018, This is the next opportunity to apply the tax-free amount. This is how it has always worked. April 1, 2018, This is the last chance to apply for a refund. It is available in 30 days. April 1, 2018, IRS says that most taxpayers will be able to file by April 20, 2018. April 1, 2018, The tax-free amount begins to reduce. April 1, 2018, IRS says that there is no limit on the amount an individual can claim on their federal income tax return for a tax year ending.